Douanes, droits et TPS

Douanes

Concernant les exportations américaines dont la valeur d'un seul produit dépasse 2 500 USD, l’Electronic Export Information(EEI) est généralement exigé des douanes et de la protection des frontières des États-Unis.

Les réglementations pour colis coûteux sont complexes. Nous vous recommandons fortement de diviser votre colis en plusieurs pour que la valeur totale de chaque colis reste inférieure à 2 500 USD. Si le reconditionnement n'est pas possible, il nous faudra préparer un formulaire EEI (Electronic Export Information) pour vous. Des frais de 40 USD sont appliqués pour ce service. De plus, les colis nécessitant un formulaire EEI doivent être expédiés via des transporteurs spécifiques qui seront disponibles pour l'envoi.

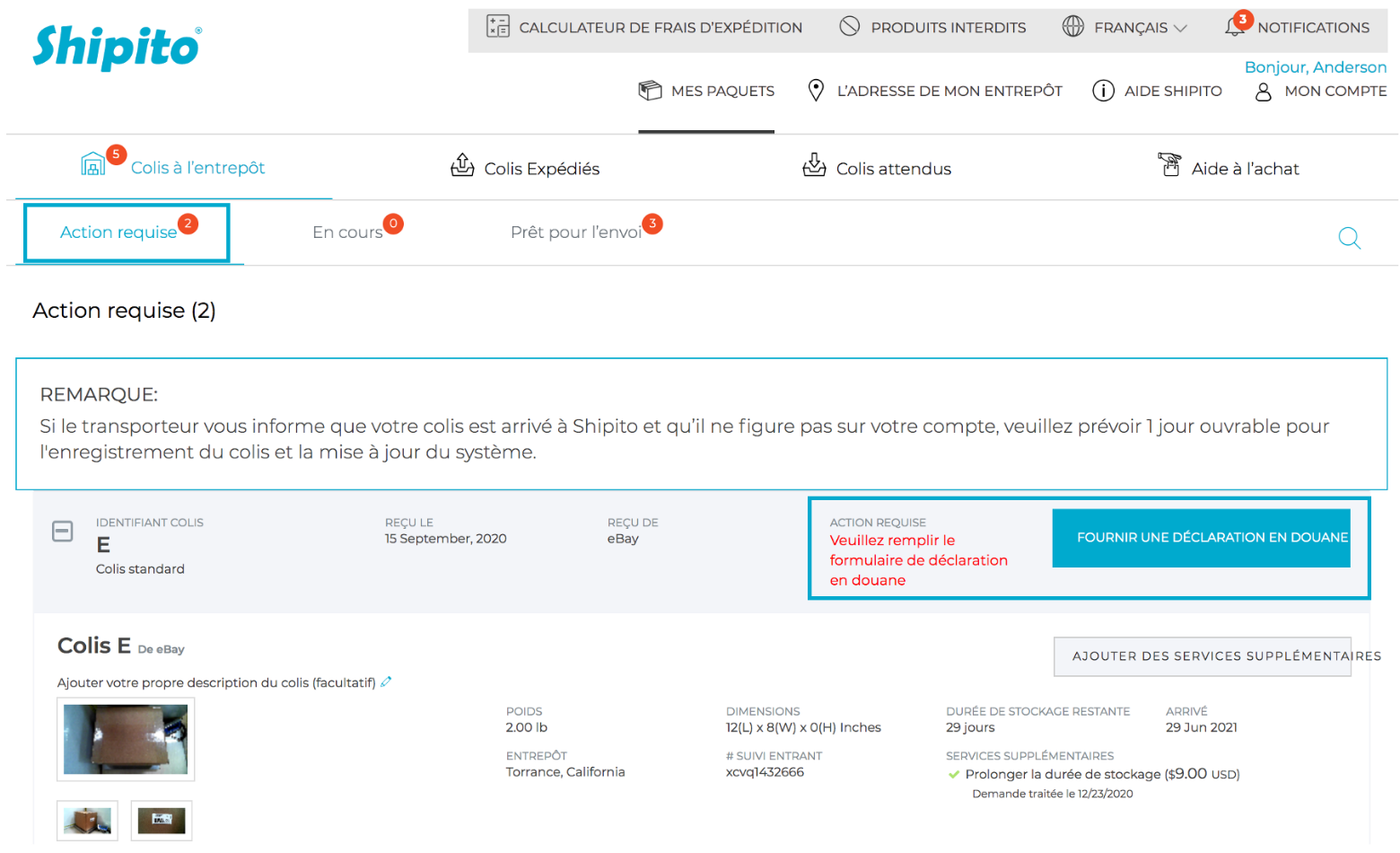

Nous ne pouvons pas vous expédier vos colis tant que le formulaire de déclaration en douane n’est pas rempli. Pour en savoir plus, vous pouvez consulter cette vidéo.

Pour remplir votre formulaire de déclaration en douane, veuillez suivre les étapes ci-dessous :

- Ouvrez votre compte

- Cliquez sur "Colis dans l’entrepôt"

- Puis sur "Remplir une déclaration en douane"

- Remplissez le formulaire de déclaration en douane

Les pays suivants n'autorisent pas l'importation d'articles usagés :

- Brésil

- Afrique du sud

- Uganda

- Vietnam

- Indonésie

REMARQUE IMPORTANTE:

- Vous n'éviterez pas les éventuels droits et taxes en sélectionnant CADEAU.

- Vous devez indiquer si le colis contient des piles ou des marchandises dangereuses.

- Si vous n’avez pas déclaré le montant exact, vous devez corriger le montant de la déclaration avant d'expédier votre colis.

- Tout remboursement se fera sur la valeur déclarée, il y va donc de votre responsabilité de vous assurer que la déclaration en douane de chaque colis, dès sa réception, est remplie de manière complète et détaillée. Comprenez également que nous ne pouvons offrir aucune compensation pour les retards dû à ¨colis perdus¨. Le remboursement est basé sur le montant minimum indiqué de la valeur déclarée ou facturée.

Oui, vous êtes responsable du paiement de tous les dédouanements, droits et taxes de douane. Ceux-ci peuvent être payés de deux manières :

- Règlement direct : en contactant le transporteur directement.

- Règlement à la livraison : en contactant Shipito 2 à 3 jours avant l'arrivée de votre colis, indiquant le nom du transporteur, le montant dû et le numéro de suivi. Puis, en déposant les fonds suffisants sur votre compte pour que nous puissions effectuer le paiement au moment de la livraison.

Si les droits et taxes de douane n’ont pas été préalablement réglés et si vous ne disposez pas des fonds suffisants sur votre compte pour couvrir ces frais, les colis peuvent être refusés et renvoyés à l'expéditeur.

TPS (taxe sur les produits et services) australienne

Les consommateurs australiens sont désormais tenus de payer une taxe TPS de 10% sur les articles de «valeur modérée» (inférieure ou égale à 1 000 dollars australiens) achetés auprès de vendeurs internationaux. Shipito perçoit la taxe TPS sur ces achats et la verse directement au gouvernement australien en votre nom. La taxe TPS est calculée en fonction de la valeur des articles expédiés, à cela s’ajoute les frais de service et d'envoi de Shipito.

- Shipito NE perçoit PAS la TPS et vous êtes tenu d’effectuer le paiement directement au bureau des impôts australiens.

Pour tout achat d’une valeur inférieure ou égale à $1,000 AUD

- Si un ABN (numéro d'entreprise australien) est indiqué dans votre dossier Shipito, vous n'aurez pas à payer de taxes lors de l’envoi, mais pourrez soumettre ces frais au gouvernement australien lors du règlement trimestriel habituel de vos taxes.

- Si vous AUCUN ABN (numéro d'entreprise australien) n’est indiqué dans votre dossier Shipito, une TPS de 10% est appliquée pour les frais de port et de traitement au moment de l'envoi.

+

Frais de 1/11 (sur les services) + 1/11 (sur l’assurance) + 1/11 (sur les coûts d’envoi)

Remarque importante : la valeur du contenu et les frais d'expédition étant deux choses différentes, 2 TPS distinctes s’affichent au moment de l’envoi.

- Rendez-vous sur votre compte

- Aller sur "Mon compte"

- Sélectionnez "Modifier mon carnet d’adresses"

- Saisissez ABN dans l'espace d'identification fiscale. L'ABN doit être indiqué pour chaque nouvelle adresse de livraison.

Chine : droits de douane, taxes et limites d'importation

Pour des envois personnels, l'importation de colis contenant plus d'un article est limitée à 1 000 CNY. Les colis d’une valeur supérieure à 1 000 CNY, et contenant plus d’un article, sont dédouanés telle une importation commerciale. Les colis d'une valeur supérieure à 1 000 CYN, contenant plus d'un article, et déclarés être pour l’usage personnel sont retournés aux États-Unis. Si le colis ne contient qu'un seul article, il n'y a pas de limite de valeur, cependant les douanes chinoises se réservent le droit d'approuver l'importation d'un colis ou de le refuser et de le renvoyer aux États-Unis, qu'il y ait 1 ou plusieurs articles dans le colis.

Si vous importez des articles d'une valeur de 20 000 CYN ou plus par an, tous les envois doivent être dédouanés en tant qu'importation commerciale.

TPS de la Nouvelle Zélande

Les consommateurs néo-zélandais sont désormais tenus de payer une taxe TPS de 15% sur les articles de «valeur modérée» (inférieure ou égale à 1 000 dollars néo-zélandais) achetés auprès de vendeurs internationaux. Shipito perçoit la taxe TPS sur ces achats et la verse directement au gouvernement néo-zélandais en votre nom. La taxe TPS est calculée en fonction de la valeur des articles expédiés, à cela s’ajoute les frais de service et d'envoi de Shipito.

Pour tout achat d’une valeur inférieure ou égale à $1,000 NZD

+

Cela s'applique également aux services, assurances et frais d'expédition.

Remarque importante : la valeur du contenu et les frais d'expédition étant deux choses différentes, 2 TPS distinctes s’affichent au moment de l’envoi.

- Ouvrez votre compte

- Rendez-vous sur "Mon compte"

- Sélectionnez "Modifier mon carnet d’adresses"

- Saisissez l'IRD néo-zélandais dans l'espace d'identification fiscale. L'IRD néo-zélandais doit être indiqué pour chaque nouvelle adresse de livraison

Exigences relatives à l'identification fiscale au Mexique en 2025

Pour garantir un traitement et une expédition sans problème :

- Mettez à jour toutes les adresses enregistrées au Mexique pour inclure le numéro d'identification fiscale du destinataire.

- Soyez prêt à fournir le numéro d'identification fiscale pour tous les envois futurs vers le Mexique.

Nous vous remercions de l'attention que vous portez à cette question et sommes là pour vous aider si vous avez des questions ou si vous avez besoin d'aide.

1. Connectez-vous à votre compte

2. Accédez aux paramètres de votre compte

3. Cliquez sur « Modifier le carnet d'adresses »

4. Cliquez sur « Modifier » sur l'adresse à laquelle vous souhaitez ajouter votre numéro d'identification fiscale

5. Ajoutez votre numéro d'identification fiscale dans le champ intitulé « Numéro d'identification fiscale/Numéro d'entreprise »

6. Cliquez sur « Enregistrer »